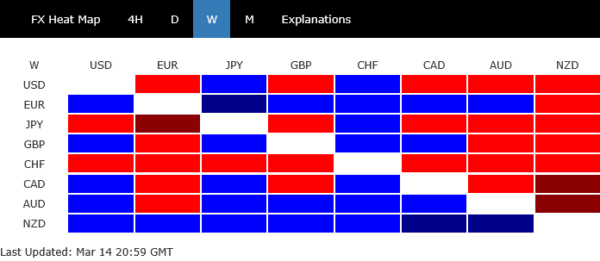

The past week in the currency markets was marked more by consolidation than decisive moves, even as risk aversion deepened in US stock markets. Dollar’s selloff slowed and turned into a modest recovery, but there was no clear momentum for bullish trend reversal. Sentiment remained fragile, weighed down by constantly escalating trade tensions and the growing impact of tariffs on American consumer and business confidence. However, with stocks and Dollar both looking oversold, markets appear to have found a temporary reprieve, allowing for some short-term stabilization.

That said, this pause does not indicate a shift in sentiment, but rather reflects a phase of profit-taking and repositioning. Traders seem to be adjusting their positions ahead of the critical tariff showdown in April, when reciprocal trade measures on key US trading partners are expected to take effect. As markets brace for the next wave of developments, uncertainty and indecisiveness have become dominant themes. This is evident in the fact that only three currency crosses closed outside their prior week’s ranges, highlighting a lack of conviction in directional moves.

Among the currency performers, New Zealand Dollar overtook Euro at last hours as the week’s strongest, but its gains lacked clear momentum for a sustained uptrend. Australian Dollar, which came in third, and Kiwi appeared to be mostly digesting their recent losses, aided by a modest stabilization in risk sentiment.

While these currencies showed some resilience, they have yet to break out of their broader downtrends, and further gains will likely depend on how global markets react to the next round of trade developments.

Euro, despite slipping to second place, could soon regain momentum, especially as Germany’s major political parties reached a breakthrough on a historic debt deal.

On the weaker side, Japanese Yen, Swiss Franc, and Dollar ranked as the bottom three performers. Meanwhile, Sterling and Canadian Dollar closed the week in the middle of the pack

Stocks Sink for the Week Despite Friday’s Rebound, April Set to Be Crucial

US stocks suffered significant losses last week, with DOW plummeting -3.1% for its worst weekly performance since March 2023. Both S&P 500 and NASDAQ also slipped more than -2% and notched their fourth consecutive week in the red. While a strong rebound on Friday briefly lifted spirits—becoming the best single day of 2025 for S&P 500 and NASDAQ—these gains were insufficient to salvage the broader downtrend that has gripped the market.

Friday’s bounce appeared to be more of a technical rebound than a shift in fundamentals. With the major indices down 10% from their all-time highs, markets had reached oversold conditions, making them ripe for short traders to take profits. However, the broader narrative remains bearish, at least for the near term. .

Tariff uncertainties will continue to cap upside momentum in stocks, at least through April. The critical turning point would come on April 2, when reciprocal tariffs from US are set to be announced. The corresponding retaliatory measures from the European Union, Canada, China, and Japan—and the potential for further US escalation in response—will dictate how deep the economic impact may run. The developments in the second quarter will ultimately determine whether the US markets are in merely a medium-term correction or entering an outright bear market.

For S&P 500, fall from 6147.43 is currently seen as a correction to the up trend from 3491.58 (2022 low) only. While further decline remains in favor, downside should be contained by 38.2% retracement of 3491.58 to 6147.43 at 5132.89.

However, firm break of 5132.89 will raise the chance of long term reversal, and target trend line support (now at around 4740).

Similarly, DOW should now be in correction to the whole rally from 28660.94 (2022 low). While further fall is expected, downside should be contained by 38.2% retracement of 28660.04 to 45703.63 at 38803.98. However, sustained break of this fibonacci level will argue that larger scale reversal is underway.

Dollar Index May Stabilize Around 61.8% Retracement Level, But Downside Risks Remain

The sharp decline in Dollar Index slowed last week, as market expectations for Fed’s next rate cut have shifted back from May to June. Despite softer-than-expected consumer inflation data, traders are acknowledging that Fed will likely need more time to assess the economic impact of escalating tariffs before making a policy move.

June FOMC meeting offers the central bank a broader window to evaluate the full effects of reciprocal trade measures and any additional retaliatory tariffs. Additionally, Fed will have a fresh set of economic projections by then, providing a more comprehensive view of inflation, growth, and labor market trends.

Technically, Dollar Index is now hovering around 61.8% retracement of 99.57 to 110.17 at 103.61. This level could provide some short-term stabilization, particularly as D RSI also suggests oversold conditions. Some consolidations might follow first, or even a notable recovery.

However, risks will continue to stay on the downside as long as 55 D EMA (now at 106.37) holds. Sustained break of 103.61 will extend the fall from 110.17 to 99.57 low (2023 low).

Eurozone Confidence Surges, DAX and Euro Poised for Further Gains

Euro and Germany’s DAX lost some momentum last week, but Friday’s bounce suggests both may be gearing up to extend their recent rallies.

In a major political breakthrough, Chancellor-in-waiting Friedrich Merz announced on Friday that he had secured the backing of the Greens for a massive increase in state borrowing. With support from the Social Democrats already in place, Merz now has the two-thirds parliamentary majority required to pass constitutional amendments.

The highly anticipated vote is scheduled for next week and, if approved, would mark a historic shift in Germany’s fiscal policy, paving the way for significant infrastructure and defense spending.

Merz’s declaration that “Germany is back” highlighted the renewed optimism surrounding both the German and broader European economies.

This growing confidence is also reflected in recent sentiment indicators. Eurozone Sentix Investor Confidence Index surged from -12.7 to -2.9 in March, reaching its highest level since June 2024. More notably, Expectations Index skyrocketed from 1.0 to 18.0, marking its third consecutive monthly increase and the highest level since July 2021. This surge represents the largest monthly improvement since 2012.

Germany’s investor confidence has also rebounded sharply, signaling a significant turnaround in market expectations. The German Sentix Investor Confidence Index jumped from -29.7 to -12.5, its strongest level since April 2023. Meanwhile, the Expectations Index surged from -5.8 to 20.5, reaching its highest point since July 2021.

For DAX, near term outlook stays bullish with 22226.34 support intact. Current trend should continue to 161.8% projection of 14630.21 to 18892.92 from 17024.82 at 23921.87. Decisive break there would pave the way to 200% projection 25550.22 next.

Nevertheless, rejection by 23921.87 will indicate medium term topping, on bearish divergence condition in D MACD. DAX should then turn into consolidations, until fresh catalyst pushes it through to new records.

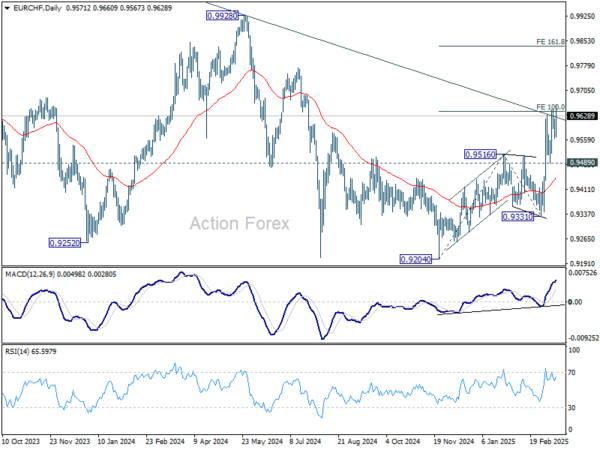

The key for Euro remains on whether EUR/CHF could decisively break through the long term channel resistance to solidify its bullish trend reversal. In this case, stronger rally should be seen to 0.9928 resistance at least.

However, break of 0.9489 support will suggest rejection by the channel resistance, and keep outlook bearish for EUR/CHF, which might also be an indication of Euro’s outlook elsewhere.

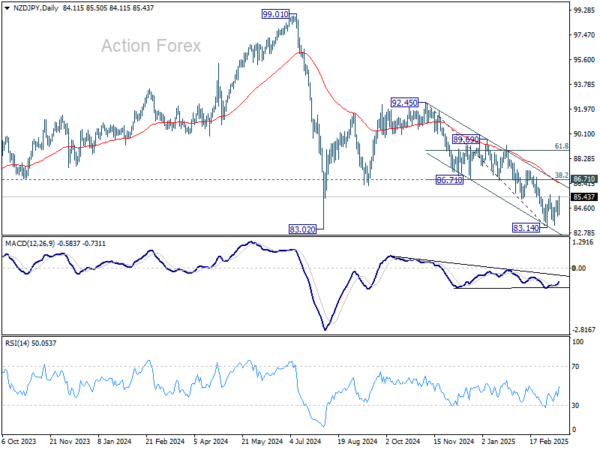

NZD/JPY as a Top Gainer, But Bearish Trend Remains Intact

NZD/JPY was among the top-performing currency pairs last week, rising by over 1.1%. However, the crosses continued to trade within falling channel that originated from 92.45 high. It’s also capped well below 55 D EMA (now at 86.45).

Thus, while the current rebound signals some near-term buying interest, the broader technical picture remains bearish.

On the upside, NZD/JPY could face strong resistance from 86.71 (38.2% retracement of 92.45 to 83.14 at 86.96). Only a firm break of this cluster resistance zone would confirm bullish trend reversal.

Otherwise, fall from 92.45 is still in favor to continue. Indeed, firm break of 83.02 (2024 low) will resume whole down trend from 99.01 (2024 high).

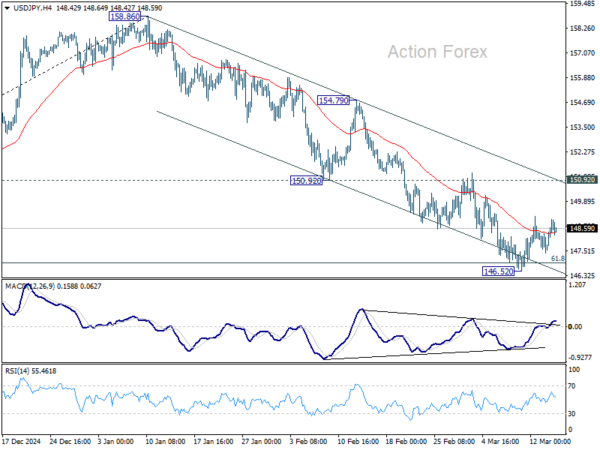

USD/JPY Weekly Outlook

USD/JPY edged lower to 146.52 last week but recovered since then. Initial bias remains neutral this week for more consolidations. Upside of recovery should be limited by 150.92 support turned resistance. On the downside, sustained trading below 61.8% retracement of 139.57 to 158.86 at 146.32 will pave the way to 139.57 support.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low), with fall from 158.86 as the third leg. Strong support should be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

In the long term picture, it’s still early to conclude that up trend from 75.56 (2011 low) has completed. A medium term corrective phase should have commenced, with risk of deep correction towards 55 M EMA (now at 136.88).