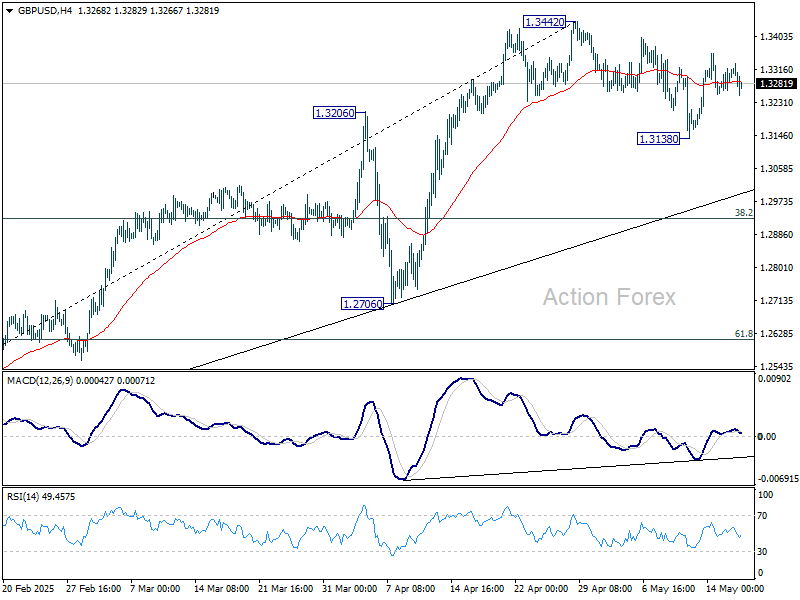

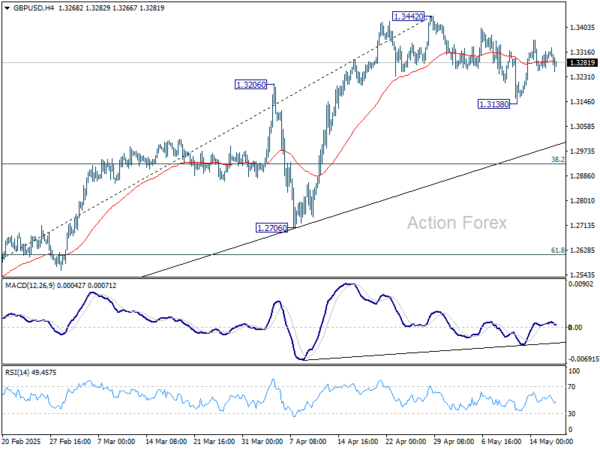

GBP/USD dipped further to 1.3138 last week but recovered quickly again. Initial bias stays neutral this week first. On the upside, decisive break of 1.3433/42 key resistance zone will confirm larger up trend resumption. Nevertheless, below 1.3138 will resume the correction from 1.3442. But downside should be contained by 38.2% retracement of 1.2099 to 1.3442 at 1.2929 to bring rebound.

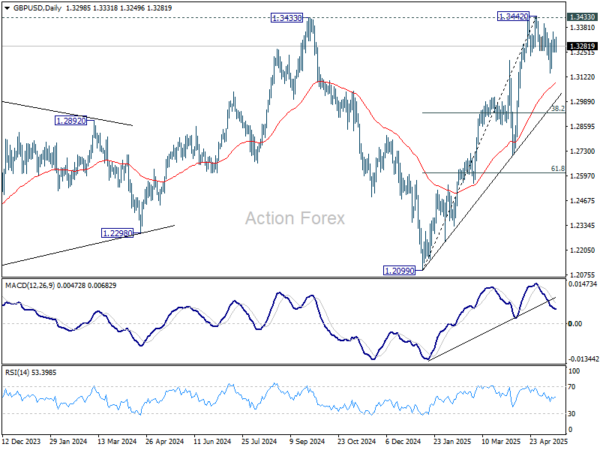

In the bigger picture, price actions from 1.3433 are seen as a corrective pattern to the up trend from 1.3051 (2022 low). Rise from 1.2099 could either be resuming the up trend, or the second leg of a consolidation pattern. Overall, GBP/USD should target 1.4248 key resistance (2021 high) on decisive break of 1.3433 at a later stage.

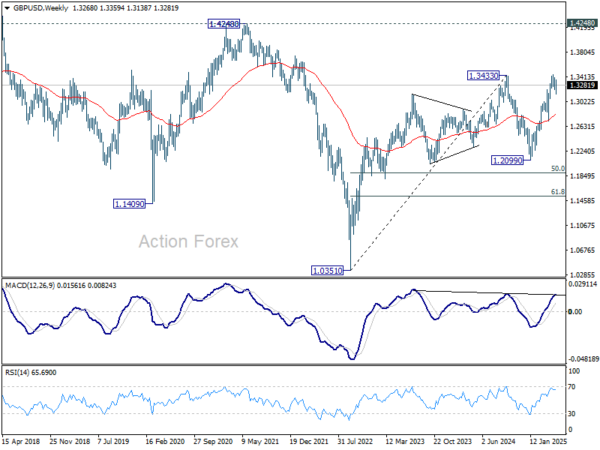

In the long term picture, price actions from 1.0351 (2022 low) are seen as a corrective pattern to the long term down trend from 2.1161 (2007 high) only. Outlook will be neutral at best as long as 1.4248 structural resistance holds, even in case of strong rebound.